Response to recent assertions related to the City's finances

Information provided in response to assertions contained within an advertisement placed in the Southern Gazette on Thursday 26 September 2019 with the title “Is the City of South Perth going broke?” and repeated in the Paul Murray opinion article on the Weekend West on Saturday 28 September 2019.

Q – Is the City going broke?

A – No. The City has over $740m of net assets, including cash of $39.5m. The City has the funds to pay its creditors as and when they fall due, as illustrated with a Current Ratio of 1.08 as at 30 June 2019 which is above the benchmark of 1.00. The City has a planned approach to managing the its finances, including considering the aspirations of the community as described in the 2017-27 Strategic Community Plan, and then delivered through the Corporate Business Plan and Annual Budgets.

Q – Has there been a ‘dramatic’ decline in Council finances?

A – No. By contrast, a ‘dramatic’ increase in cash occurred in 2014/15 and 2015/16 when the City sold land, as described in the 2015/16 Annual Report on page 125 (extract below). In addition to the increase in cash, these land sales facilitated the private development of the Civic Heart, parking at the Windsor Hotel (Ray St) and residential units within the Manning Hub (Bradshaw Cr).

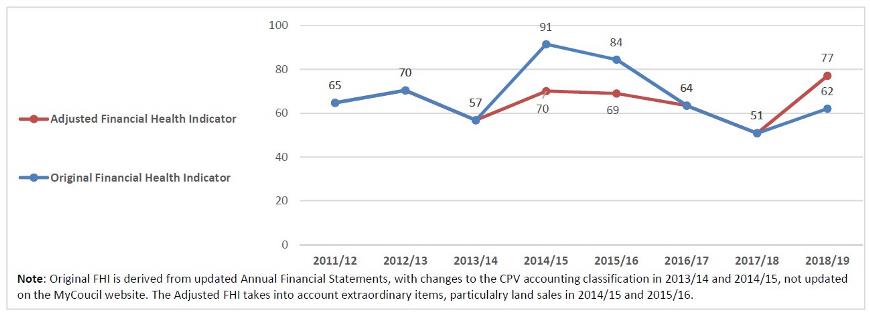

The subsequent decline in cash occurred for the intended purpose of developing the community assets being Manning Hub and the redevelopment of EJ Reserve/John McGrath Pavilion and Hall in accordance with adopted plans and budgets. When eliminating these extraordinary transactions, the answer to this question is emphatically no, there has not been a ‘dramatic decline’ in Council finances, as depicted in the graph below.

The question in the advertisement was followed by a graph of FHI scores to illustrate a ‘dramatic decline’. The FHI is discussed in further detail below, in particular that this score, developed by the State Government, is considered by many to be flawed and subject to timing distortions. By way of example, within the 2015/16 Annual Financial Statements, the accounting treatment for the Collier Park Village (CPV) Liability was changed from Non-Current to Current, having an impact on the Current Ratio and FHI. The MyCouncil website has not been updated, as the 2014/15 FHI on the website has a score of 97, whereas the revised score is 91.

Q – Are the cash reserves spiralling downwards?

A – No. Cash reserves increased when land was sold and subsequently cash reduced as those funds were used to build the community assets being the Manning Hub and EJ Reserve/John McGrath Pavilion and Hall. These developments were planned and communicated via the numerous media releases, published articles, website articles and contained within Annual Budgets and Annual Reports. The advertisement included words that may have led the reader to conclude that the use of cash was spiralling out of control. Nothing could be further from the truth. The sales and subsequent use of these funds for community purposes was planned and executed in accordance with Council resolutions, through the Budget process as well as through Council acceptance of various tenders for contractors to build the facilities. These processes were completed in accordance with the Local Government Act 1995 and Regulations.

Q – How was the Financial Health Indicator (FHI) score created?

A – Regulation 50 of the Local Government (Financial Management) Regulations 1996 was amended to include new ratios for the 2012/13 Financial Statements, totalling seven in all. In 2016, WA Treasury Corporation (WATC) operating on behalf of the Department of Local Government, Sport and Cultural Industries, issued specifications that have been used to derive the Financial Health Indicator (FHI) scores included at www.mycouncil.wa.gov.au.

The seven ratios which are included in every Annual Report are supplied as “Raw” ratios. The model developed by WATC creates a standard score between 0 and 10 for each ratio. The total maximum standardised score is 70 although this is not depicted on the MyCouncil website.

These seven individual standardised scores then have a weighting applied to calculate the FHI to a maximum total of 100. The Current Ratio and the Operating Surplus ratio are heavily weighted representing a maximum of 46, with the remaining five ratios totalling 54.

Q – Many of the ratios and FHI scores have been relatively consistent over the eight years since these ratios were introduced. What are the anomalies that explain the FHI score of 91 in 2014/15 and 84 in 2015/16?

A – These high scores are attributable to the profit achieved on the sale of land, as described in the 2015/16 Annual Report on page 125. Had these land sales not occurred, the FHI would have been 70 and 69 respectively, a score similar to those achieved during the other years.

Q – 2017/18 has the lowest FHI score over the eight years, what occurred in this year?

A – The main difference in 2017/18 is the score relating to the Asset Sustainability Ratio of 0. In this year, the creation of new assets was the focus of the capital works budget, rather than upgrading existing assets. In years when this occurs, a score of 0 is likely. However, the City is currently finalising 2018/19 Annual Financial Statements, with the staff from the WA Auditor General. A review of previous year figures is required to complete the Annual Financial Statements, ensuring Regulation changes are reflected in both the current and previous financial years. It is anticipated in finalising the 2018/19 Annual Financial Statements for presentation at the Annual Meeting of Electors, the 2017/18 FHI is likely to increase. Any audited changes to the previous FHI will be submitted to the Department of Local Government, Sport and Cultural Industries to update the MyCouncil website.

Q – Operating Surplus Ratio is a large component of the FHI, should Council even make a profit?

A – All Councils are responsible for determining if their budget should include an Operating Profit each year. Generally the Not for Profit sector attempt to break even or derive a small profit. It has been suggested that a Council that earns large profits is doing so by overcharging on rates and/or fees & charges. If a small loss, break even or small profit is considered appropriate, why does the weighting within WATC model focus on deriving a commercial operating surplus to achieve financial health?

With the exception of the two years of land sales, the City has consistently made an operating loss. This is not new information to Council, staff or the public. The 2016/17 Annual Report describes the issue, as does each Annual Budget and half year review. During the 2018/19 Budget, Council was conscious of household financial pressures and resolved to adopt a 1.6% rate increase in line with the Local Government Cost Index (LGCI). In keeping rates low, Council were looking to increase non-rate revenue, particularly moving towards a more user-pay philosophy in parking fees. The City took a range of steps to reduce expenses and invest in the 1System project to replace the old systems, delivering increased e-services and improving productivity.

The focus over the short to mid-term (two to four years) is to increase non-rate revenue and reduce costs, whilst maintaining service levels. Council resolved to reduce the 2019/20 rate increase to 1% based on CPI, rather than LGCI. In addition, changes to parking have reduced annual revenue. These decisions adversely impact the ability to deliver an operating profit.

In terms of being mindful of household finances, the 2019/20 rate increase for the median residential property resulted in an additional $25.59 per year, being less than 50 cents per week. A residential property purchased for $8.5m had a rate increase of $41.56 per year, being less than 80 cents per week.

Q – Is it possible to have an operating loss each year and still be financially viable?

A – Yes. Local Government relies heavily on capital grants from Federal and State Governments. Whilst these capital grants do not form part of the Operating Surplus Ratio, the annual depreciation expense does. In many circumstances, grants cover 50% of the asset cost, therefore Council funds the remaining 50%. Yet 100% of that depreciation cost will form part of the annual operating expenses over the life of the asset. Uniquely, the capital grants facilitate Council to remain financially sustainable regardless of incurring an operating loss. If Council were to budget for a $1 loss each year, the maximum FHI score that could be achieved would be 79, only 9 points above the score (70) that WATC consider to indicate good financial health.

Officers recommend a small operating profit year on year to ensure community assets are maintained and services delivered to the level expected by the community.

Q – Is the City interested good financial health?

A – Yes. The City has undertaken many initiatives to continue to improve its financial health. Included in the 2017-2027 Strategic Community Plan is the strategy to increase non-rate revenue. The City established a Property Committee of Council to oversee commercial opportunities, including land development, to generate more non-rate revenue. Aligned to the Parking Strategy, officers recommended a range of changes to parking fees, in line with a user-pay philosophy. Other fees and charges have been kept to a minimum to support sporting and other associations, such as senior citizens. A Business Plan has recently been advertised to introduce mini golf at the Collier Park Golf Course to increase non-rate revenue. In terms of expenditure, numerous reviews have been undertaken to reduce expenditure whilst attempting to maintain service levels. The 1System Project, replacing old systems will result in productivity improvements through delivery of e-services, as well as lower overall system costs.

Q - Is FHI a good indicator of financial health?

A – No. Many professionals question the model, believing the ratios, as well as the FHI model are fundamentally flawed and misleading.

The main concerns of the FHI model relate to its technical design, the weighting of each ratio and the absolute benchmarks. The timing of transactions may have a significant impact on the score. Many of these timing issues are peculiar to Local Government and outside the Council’s control.

Ron Back Consulting, who regularly provides WA Local Government financial information to the State Government and WALGA, has raised serious concerns. The Financial Officers Network within the peak body, Local Government Professionals WA, have also raised concerns and commenced a FHI review process. It is understood that WALGA have made a submission on the ratios during the reform process and that the WATC has commenced a review of the FHI model.

In terms of the ratio weightings, almost half (46) of the total score (100) relates to only two items, the Current Ratio and the Operating Surplus Ratio. If Council were to achieve above the benchmark on five (other) ratios, whilst not meeting the Current and Operating Surplus Ratio benchmark, the FHI score would be 54.

Also, the established benchmarks are rigid, in that the benchmark for each ratio is either met or not. In addition, there is no benefit for achieving beyond the high benchmark, making comparison meaningless.

The rigid benchmarks, together with the high weighting of the Current and Operating Surplus Ratio, amplify FHI fluctuations between years. By way of example, in late June each year the Federal Government determine the timing of quarterly payments of the Federal Assistance Grants (FAGs). In some years they determine to only transfer 50% to 75% of the annual FAGs, in other years it may be 125% to 150%. A change from what was budgeted is at the sole discretion of the Federal Government and may result in the FHI score dropping by 46 points.

Geoff Glass

Chief Executive Officer

4 October 2019

Media contact

- Phone 9474 0777

- Email media@southperth.wa.gov.au